Consumer Behavior is Changing Fast—Here’s What to Do Before It Leaves You Behind

Last week, our friends over at CDG ran their first-ever Consumer Snapshot Survey to check the pulse of buyers in the wake of the latest auto tariff tantrum. And while the data might seem like a bowl of mixed nuts—some people pausing, others pouncing—there’s a clear undercurrent if you’re paying attention.

Translation? The market is whispering. You just gotta know what to listen for.

After breaking down the survey data and triangulating it with fresh stats from J.D. Power, Carfax, and the University of Michigan, three big consumer behaviors jumped out like a squirrel at a tire test track.

Let’s break ‘em down:

🔻1. Buyer Interest Is Dropping… But Only for the Unprepared

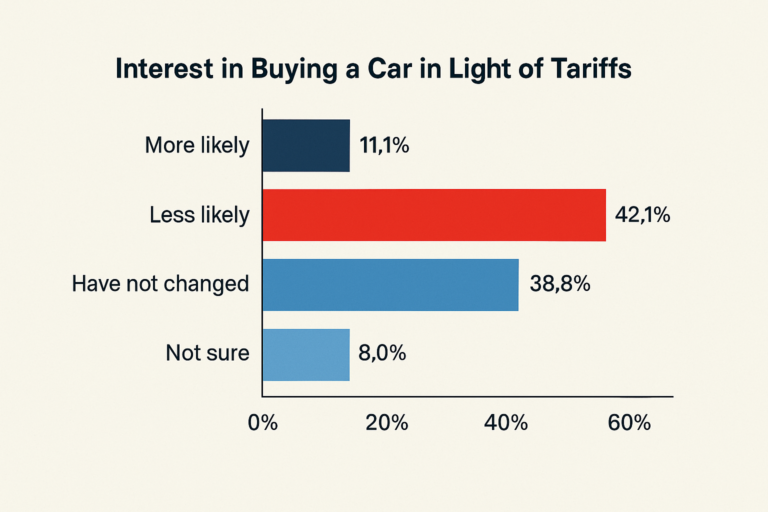

According to CDG, 42.1% of consumers say they’re now less likely to buy a car thanks to tariff drama. That’s a big ol’ speed bump.

But wait—it gets weirder.

J.D. Power says April was on fire—up 10.5% year-over-year, thanks to 139,000 folks rushing to buy before price hikes hit. But that spike had the lifespan of a TikTok trend. By week three, it cooled off faster than a test drive in a Minnesota blizzard.

Why? OEMs guaranteed stable prices through summer, and consumers exhaled. Temporarily.

But behind the calm, something started shifting:

19.2% are switching to smaller, less expensive cars.

27.4% say they’re now more likely to buy used.

This isn’t panic—it’s preparation. Buyers aren’t fleeing the market… they’re flanking it. They’re ducking into what feels “safe” while the storm clouds gather.

Dealer Reality Check:

CPO, used, and compact inventory?

High-priced SUVs and tariff-heavy imports?

Buyers feel some urgency… but they’re not dumb. They want future-proof deals, not future regrets.

2. Trade-Ins Are Stalling—And That’s Gonna Sting

Consumers see what’s coming: Used car prices are going up (again). Carfax backs it up:

Pickup trucks: +$660

Luxury SUVs: +$600

Hybrids & EVs: +$250

Minivans & luxury sedans: +$160

(All MoM, April 2025)

But here’s the twist—41.1% of consumers say they’re less likely to trade in their car right now. Why? Because they know that the ride they have today might be worth more tomorrow.

Pile on the fact that 61.7% say they feel less confident in their ability to afford a new ride, and you’ve got a recipe for frozen trade volumes.

Dealer Reality Check:

Waiting on lease returns?

Hoping for easy auction fills?

The smart dealers are going old-school—street sourcing, driveway deals, and building a serious fixed ops fortress. Service, parts, collision—they’re back in the spotlight.

3. Confidence is Cracking—and Deal Structures Are Getting Weird

This one should make you sit up straight:

80.5% of consumers feel more cautious about the market.

Only 4.8% feel more optimistic.

(CDG Consumer Snapshot Survey)

That’s not a red flag—it’s a whole marching band.

People aren’t just changing what they buy. They’re changing how they buy:

13.1% are going all-cash (less risk, fewer strings).

10.7% are leaning into leases (hedging depreciation).

Buyers remember getting roasted in 2021-2022. Upside-down loans. Sky-high prices. No way out. They’re not doing that dance again.

And the data backs it: The University of Michigan’s Consumer Sentiment Index dropped 8% MoM in April—and a brutal 38% since January. That’s the worst 3-month dive since the 1990 recession.

Dealer Reality Check:

Drop the “best deal in town” shtick.

Start talking least risk, most flexibility.

Cut the fine print. Keep the fees simple. Say what you mean.

Buyers are scanning for red flags—and if you smell like uncertainty, they’ll vanish faster than a Mirage on a finance app.

Big Picture: Adapt Fast or Get Left Behind

Right now, car buyers are doing more than deciding when to buy.

They’re rethinking how to engage with the entire industry.

The next 90 days will be a proving ground.

If your team can pivot—on inventory, on messaging, on customer conversations—you’ll win. If not? Well, the market has a way of separating the ready from the roadkill.

So ask yourself:

Are you selling like it’s 2021? Or adapting for 2025?

Tariffs may shake the system. But your strategy? That’s still in your hands.

—

Sources:

CDG Consumer Snapshot Survey: Tariff Edition, April 2025

J.D. Power April Forecast, 2025

Carfax Used Vehicle Market Insights, April 2025

University of Michigan Consumer Sentiment Index, April 2025